No one knows how to kill a good party like the California Department of Tax and Fee Administration (CDTFA). In a recent move to perplex the entire state of California, this agency that’s responsible for determining California cannabis taxes and the cannabis mark-up rate every six months moved to increase the cannabis tax as of January 1, 2020. Moreover, this decision leads us into a great question – just how many cannabis taxes are there in California? Secondly, which taxes are staying the same and which taxes are going up?

Taxes in the supply chain

-

- Cultivation Tax

- Local Manufacturing Tax

- Distribution Tax

Taxes at the register

-

- Excise Tax (15% of Average Market Price determined by CDTFA)

- Local City Cannabis Business Tax (5-8% usually)

- State Sales Tax (7-8.5%)

Timing is Everything Until it’s Not

This wouldn’t be much of a surprise except for the incredibly questionable timing. On the heels of the recent vape related health crisis, the higher cannabis tax is a risky move. Experts fear that an increase in the taxes on cannabis will force consumers to seek black market options. This is a legitimate worry in a state that’s shown a year to year decline in legal cannabis sales while boasting a thriving black market.

According to The United Cannabis Business Association, there are nearly 3,000 illegal sellers of cannabis statewide, including storefronts and delivery services. That’s three times the legal cannabis businesses in operation. In addition, certain online platforms make it possible for illegal cannabis operations to thrive by allowing them to advertise. Therefore exploiting, what some believe to be, a simple supply and demand problem. There aren’t enough licensed retail locations to meet the demand, driving people to the black market.

When California voters legalized cannabis in 2016, they set into motion a process that would allow a regional approach to the law. Cities and Counties within the State were allowed to vote on whether to allow or disallow cannabis sales. As a result, less than 25% of California cities allow legal cannabis sales.

Cannabis Tax Increase Explained

The changes that CDTFA announced are cannabis cultivation tax and excise mark-up rate calculation increases. These are just two of the multiple taxes on our cannabis that will be increasing on January 1, 2020.

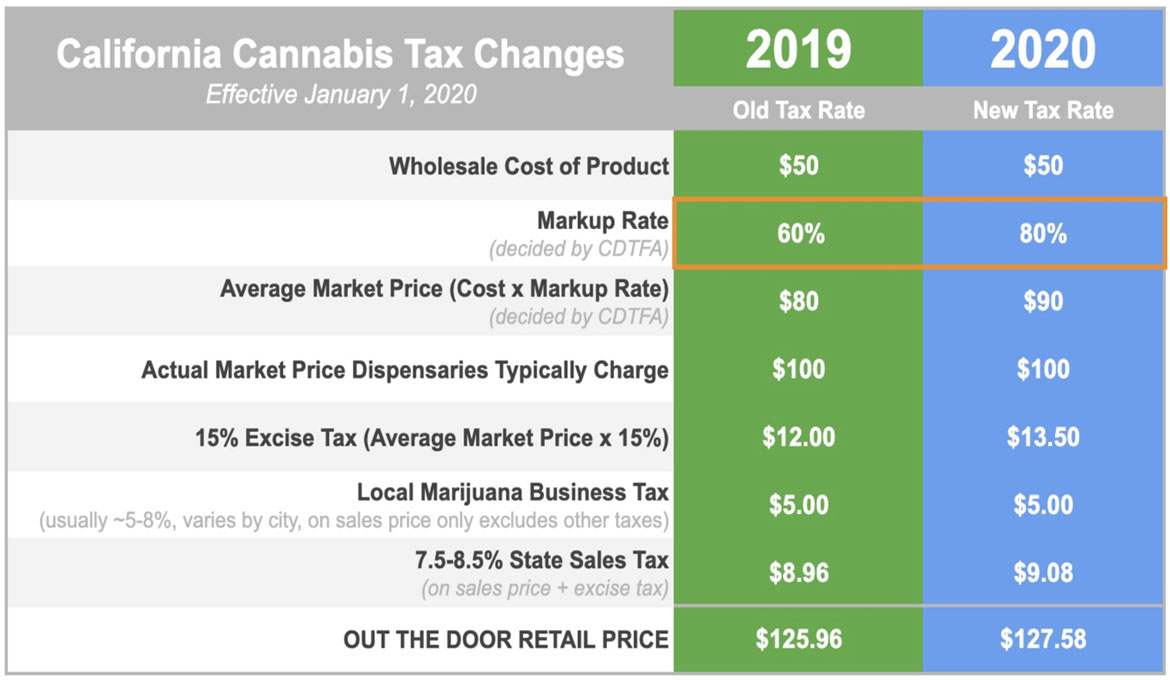

The State excise tax of 15% is charged on the average market price of the product being sold. How is the average market price determined? The CDTFA calculates this number by taking the wholesale cost of the product and multiplies it by the mandated mark up rate, currently 60% in California. The agency determines this mark-up rate number every six months. Their plan is to increase the mark-up rate from 60% to 80% on January 1, even though industry experts have warned against it. It’s complicated to understand, so we put together a little infographic below to show you what taxes are being applied to your purchase at a retail cannabis business.

The cultivation rate gets adjusted annually for inflation. This 2020 increase represents adjustments of between 4.3% and 4.6%.

- An increase to $9.65 from $9.25 per ounce of dried cannabis flower.

- An increase to $2.87 from $2.75 per ounce for cannabis leaves.

- And an increase to $1.35 from $1.29 per ounce for fresh marijuana plant material.

Keep in mind this guide is not meant to be completely accurate in all retail purchase situations. It is a general reference guide so you can understand the basics of California cannabis tax calculations and why things cost so much when you purchase from a licensed retailer. There are many more nuances to cannabis tax law such as compounding tax laws which can vary by city and purchases on apparel, merchandise and smoking accessories which are all taxed in special ways according to California cannabis tax law.

Legitimate Gripe

It may be too much to ask for tax regulators to evaluate the societal impacts of the impending cannabis tax increase. Furthermore, industry leaders have a legitimate gripe as well as a public health concern when they forecast a rise in black market sales.

Legal dispensaries are going to be competing for business more than ever. Therefore, the ones that do a good job curating deals, opportunities, and building their community will be most likely to survive the changing legal landscape. Buzz Delivery has your back. We want to encourage you to shop legal, with the most competitive pricing and customer rewards the industry has to offer.

Lastly, the possible silver lining is that the impending cannabis tax increase has ignited a fiery discussion. Therefore a renewed interest by the public over sensible cannabis legislation can be pursued moving forward.

California Department of Tax and Fee Administration (2019). Cannabis Rate Changes Effective January 1, 2020 Retrieved from https://chroot/home/a6f11fea/buzzdelivery.org/html.cdtfa.ca.gov/formspubs/L720.pdf

Chris Roberts (2019, November). California Just Jacked Up Weed Taxes. The Black Market Could Cash In Retrieved from https://chroot/home/a6f11fea/buzzdelivery.org/html.vice.com/en_us/article/ne8x5x/california-just-jacked-up-weed-taxes-the-black-market-could-cash-in

Dennis Romero (2019, September). California’s cannabis black market has eclipsed its legal one Retrieved from https://chroot/home/a6f11fea/buzzdelivery.org/html.nbcnews.com/news/us-news/california-s-cannabis-black-market-has-eclipsed-its-legal-one-n1053856